In 2019, the Nobel Prize for Chemistry was awarded to Professors Goodenough, Whittingham and Yoshino for developing the lithium-ion battery. The lithium-ion battery is an important leap in mobility, storage, and perhaps human innovation, given that human lives (in urban centres at least) are today centred around electricity. Lithium is high energy conducting and a high-density metal when it is used in a lithium-ion battery. Not only does it reduce the risk of overheating by melting (also known as flat discharge), but helps reduce trapping heat when a circuit closes.

These chemical properties of Lithium make the lithium-ion battery a lucrative metal for emerging markets in electric vehicles, smart grid storage technologies, and consumer electronics (including mobile phones, household appliances, laptops and other consumer electronics). Thus not only has the relevance of lithium grown in the past decade alongside its prices rocketing from $5000 per tonne in 2015 to $24,000 per tonne in a single year, but the importance of stakeholders involved in the supply chain has grown too.

Two of the world’s regions, the Argentina, Bolivia, Chile triangle and Australia compose of the world’s 58% of Lithium brine and ore reserves respectively and control approximately 95% of the global lithium supply in the forms of Lithium carbonates, lithium hydroxide and lithium ore and brine trading across regions. Interestingly, however, it is a Chinese company, Tianqi Lithium and its subsidiaries that control 48% of the global lithium supply. Controlling majority stakes in nearly all Australian Lithium ore mining companies (51% in the Greenbushes field), and with the recent acquisition of 24% stake in SQM Chile, Chinese corporations have successfully overhauled the global lithium supply chain in two ways: either by becoming direct customers by producing batteries which are thereafter used to produce Electric Vehicles (EVs), smart grids, or electronic goods or by producing the chemical and sourcing it to downstream companies. Intuitively, this makes commercial sense. With highly volatile-speculative markets, supply chain integration lowers costs for Chinese firms. It further helps secure local demand for EVs. Firstly, this strategy falls into the policy framework of the China National Development and Reform Commission that projects China itself will have 3 million EVs by 2025. Secondly, as China produces two-thirds of the world’s lithium batteries, by integrating supply chain it can achieve economies of scale in lowering lithium extraction costs, lithium chemical production costs, and transaction costs. Most recently, the cost of lithium extraction has come down to $2180 per tonne (while prices were fluctuating between $12,000 to $20,000 per tonne).

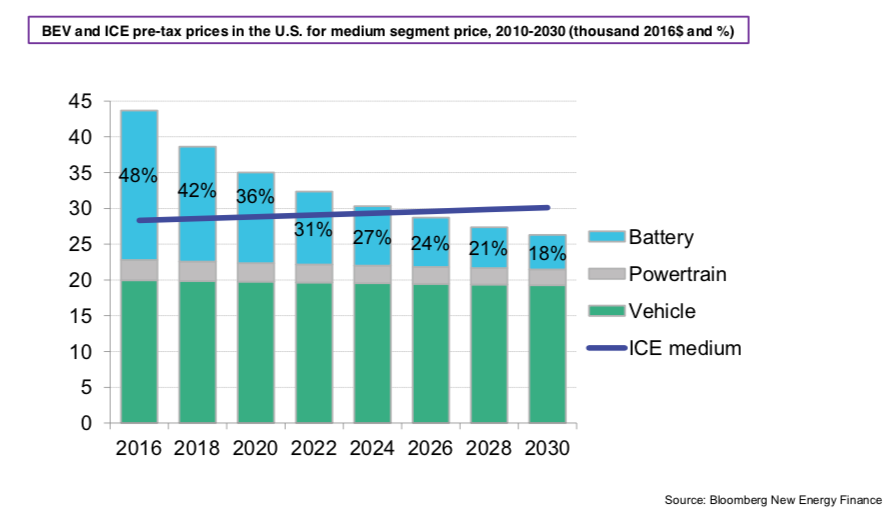

However, the market has recently seen unusual volatility due to Chinese policy too. By creating an artificial demand for electric vehicles following a 60% subsidy on EV costs (on lithium-ion batteries), the Chinese market installed large electric buses, cabs across major cities. This resulted in almost 1 million EVs in China in 2017 alone. However, gradually pulling out of the subsidy, the government, in 2019, drove global lithium prices to a half instead.

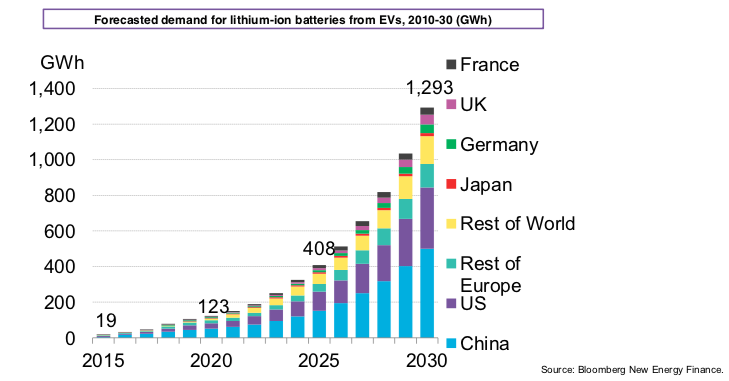

This volatility is only bound to rise in the future. China holds and is projected to hold the largest share of global lithium trade in all compounds and products. It is projected to have 1.4million tons of demand per annum by 2030, led by production for EV, Hybrid, and CE batteries. Importantly, it is the EV market, led by China, that will need lithium installation capacity of 400+ GWh in the global scale of 1300 GWh by 2030.

While the dominance by Chinese conglomerates only helps us enhance global EV penetration, shifting from internal combustion engine cars, it must be noted that policy-driven boom-bust cycles are not healthy, especially for a limited metal as lithium. After poaching Australian ores, now the growing number of acquisitions of Chinese firms in the ABC triangle only raise concerns about a global subjugation in an electronic world.

By Rhythm Banerjee