By: Qiu Quan Kua

qiu.kua@graduateinstitute.ch

Environment, Social and Governance (ESG) criteria are widely used by investors (investment funds, pension funds, institutional investors etc.) to gauge the operations of their investee companies, and by companies to gauge their own performance. The criteria are typically sets of standards, and examples of indicators include:

– Environmental: carbon emissions, water usage and conservation, efforts addressing climate change;

– Social: Labour conditions, impact on local communities, human rights efforts and risks;

– Governance: the company’s leadership, internal policies and controls, salary range, shareholder rights, board member diversity etc.

As the process of collecting information on the ESG criteria for individual companies might be resource-intensive, many investors rely to some extent on third-party ESG rating agencies, in order to incorporate ESG concerns into their investment portfolio. The agencies generally depend on publicly available information and survey questionnaires results from companies rated. Some of the largest ESG rating agencies include the Thomson Reuters ESG Research Data, Bloomberg ESG Data Service, Dow Jones Sustainability Index, and the Sustainalytics Company ESG Reports.

In this blog post, I look at an ESG report from the Dow Jones Sustainability Index (DJSI) on Newmont Mining Corp. The choice of the rating provider and extractive company is based on the public availability of the report. In this case, both a summarised DJSI report on Newmont and the main questionnaire employed to collect information for the reports are available online. Further, the DJSI also provide the ESG scoring methodology here. Thus, this post hopes to shed some clarity of how ESG is quantified.

According to the DJSI 2018, Newmont is an “Industry Leader” which leads the metals and mining industry based on the Corporate Sustainability Assessment conducted. This may be surprising to some observers given Newmont’s controversial record as a shareholder in the Yanacocha gold mine located in Cajamarca, Peru, as well as the nearby Conga copper/gold mine which was eventually put on hold indefinitely due to local community opposition.

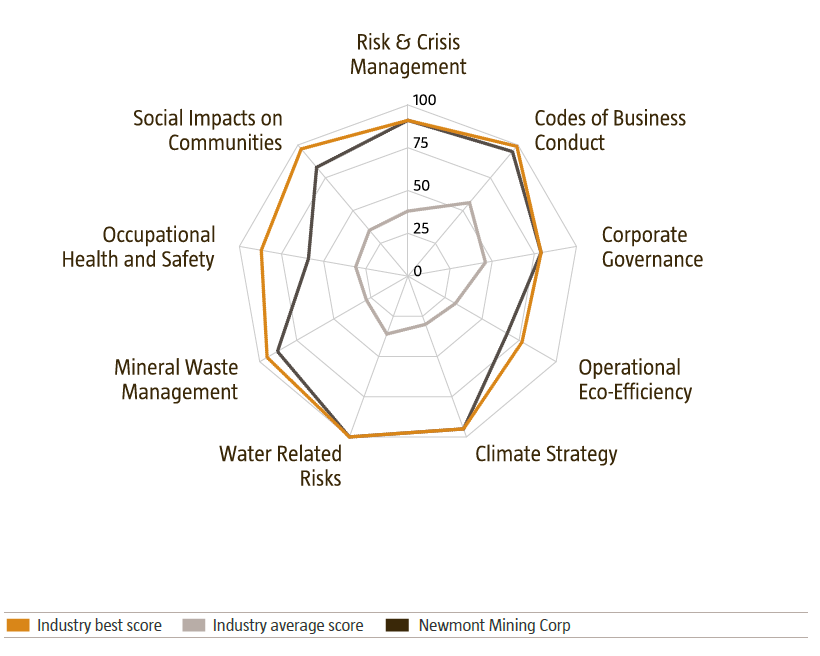

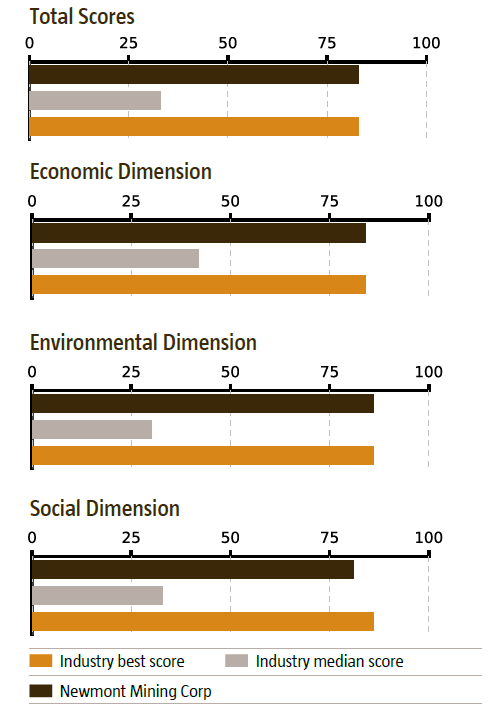

Figures: Newmont Mining Corp’s Sustainability Performance, DJSI 2018

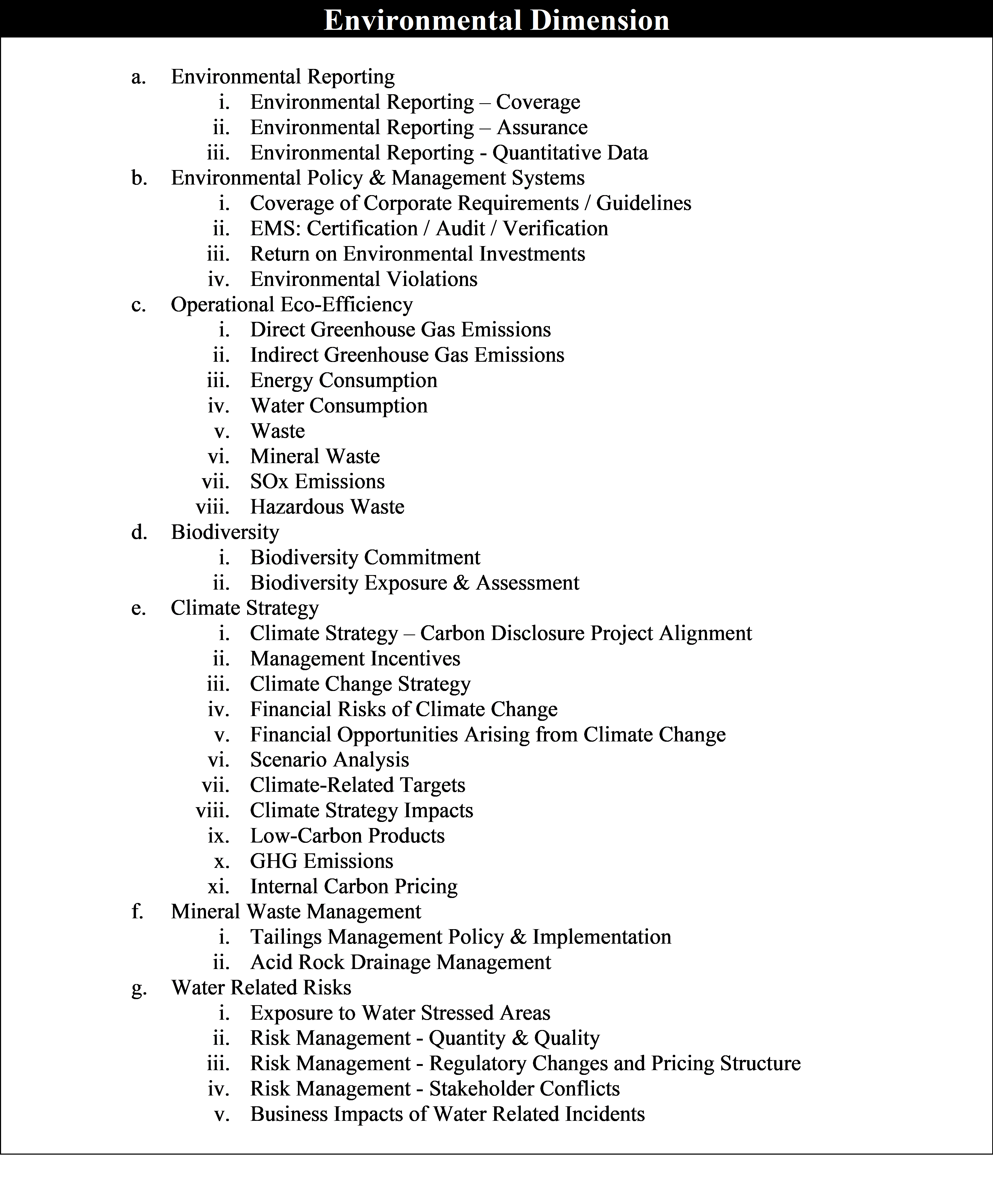

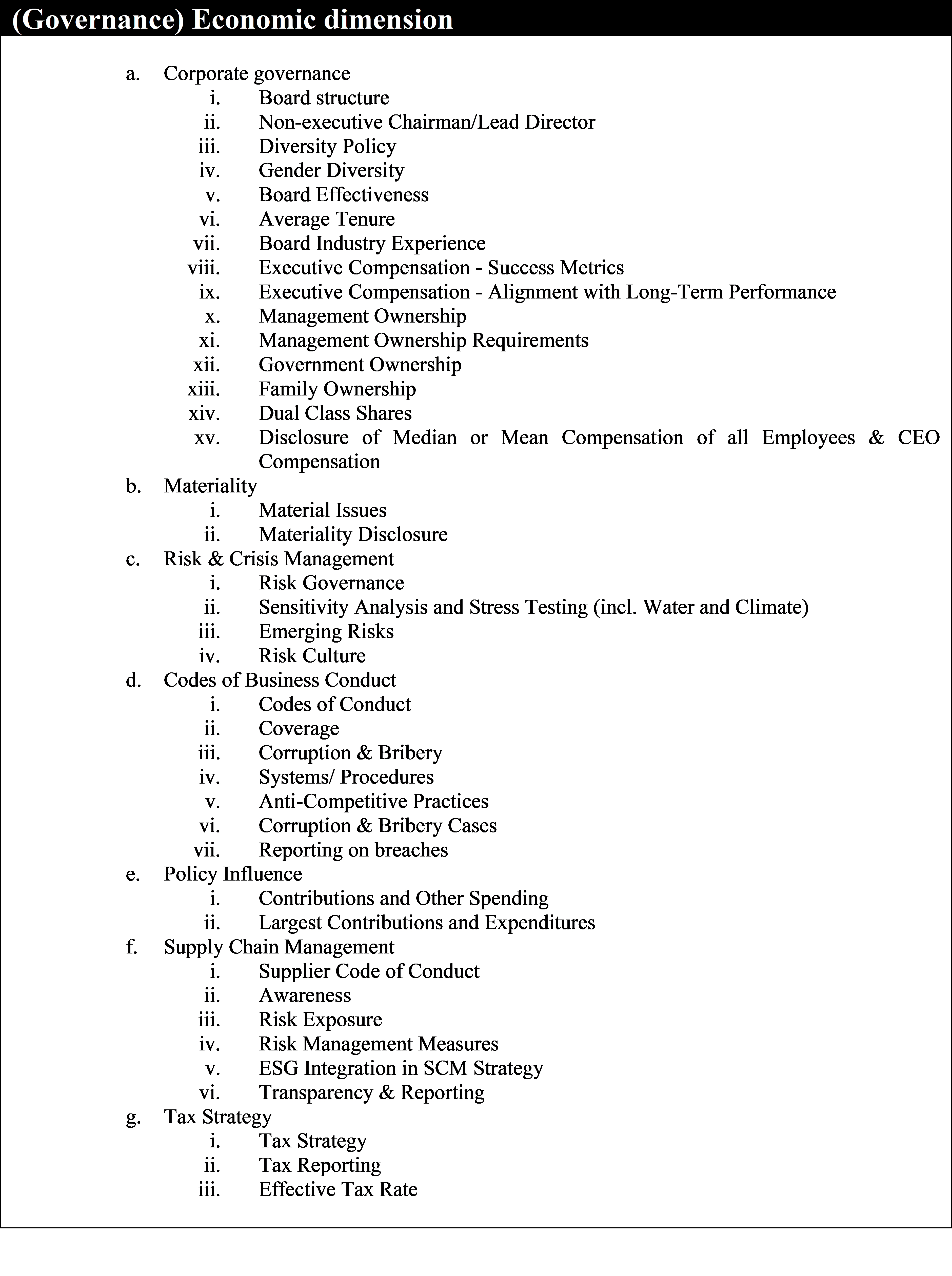

From the figures from DJSI, it appears that in all aspects, Newmont is performing much above industry average and in fact performed the best in several indicators. What constitutes the information collected by DJSI 2018 to make up the rating scores of Newmont? The below tables summarises the issues and sub-issues investigated by DJSI:

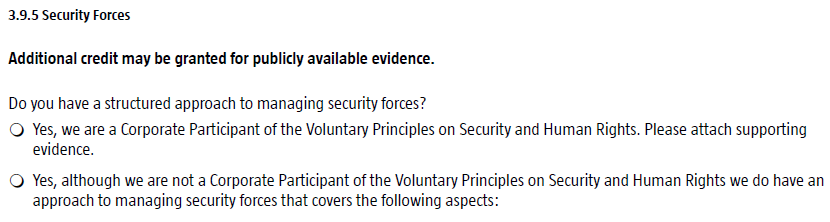

For each question posed to the observed company such as Newmont, it is clearly stated in the questionnaire that Newmont (or other extractive company participating) that “this question requires publicly available information”. While on the first glance this may be puzzling given that disclosure of non-public information appears important to understanding the ESG impact of the company, it is perhaps understandable because (1) DJSI is unlikely to have additional resources to verify non-public information and (2) the issues included do appear comprehensive and should include the most significant ESG issues. In addition, DJSI also carry out a Media and Stakeholder Analysis (MSA) for all the topics investigated, with the main purpose of reviewing if “the consistency of a company’s behavior and management of crisis situations is reviewed in line with its stated principles and policies”. The MSA is then translated to a performance score, and is conducted by a “responsible analyst” within the extraction industry. Leaving sections of the survey blank would lead to deduction of score tabulated.

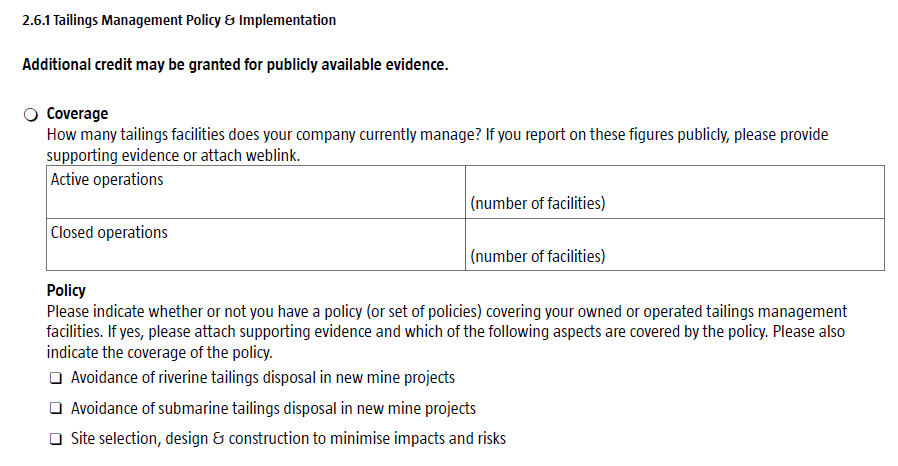

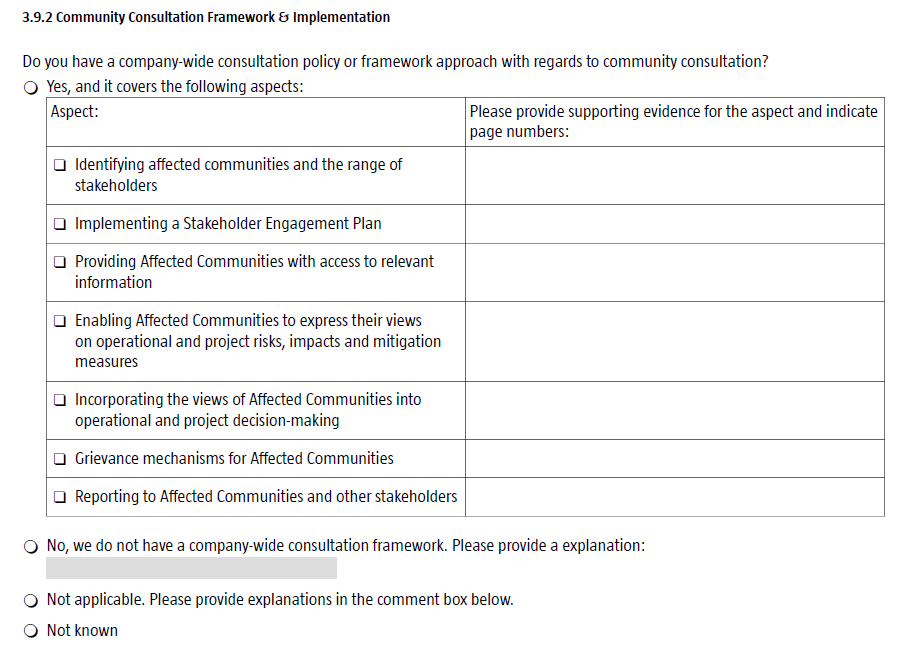

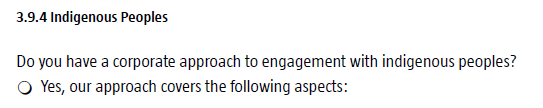

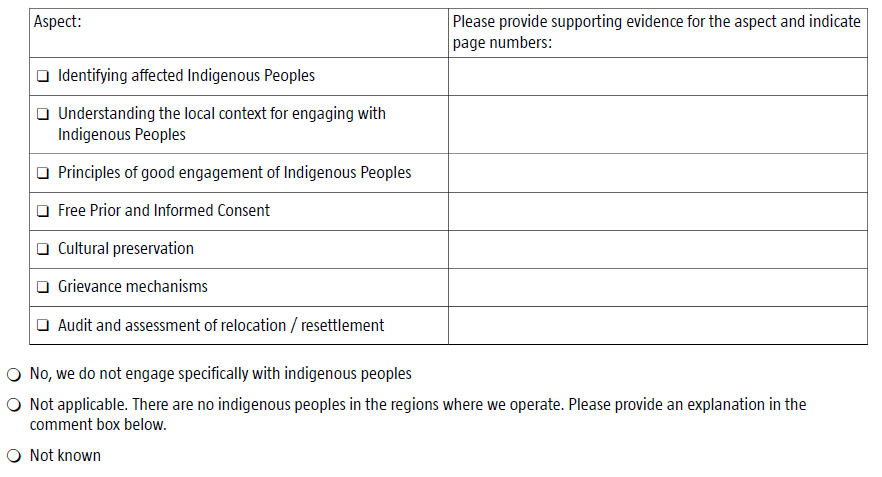

For the purpose of understanding the ESG rating process, this post briefly looks at two sub-issues studied: Mineral Waste Management (under Environment criteria) and Social Impacts on Communities (under Social criteria). These are some of the most common concerns faced by mine sites. For more details please refer to the questionnaire directly, with the link provided above.

Examples of information requested from Newmont (and other mining companies) by DJSI:

e.g. Mineral Waste Management

e.g. Social Impacts on Communities

Media and Stakeholder Analysis

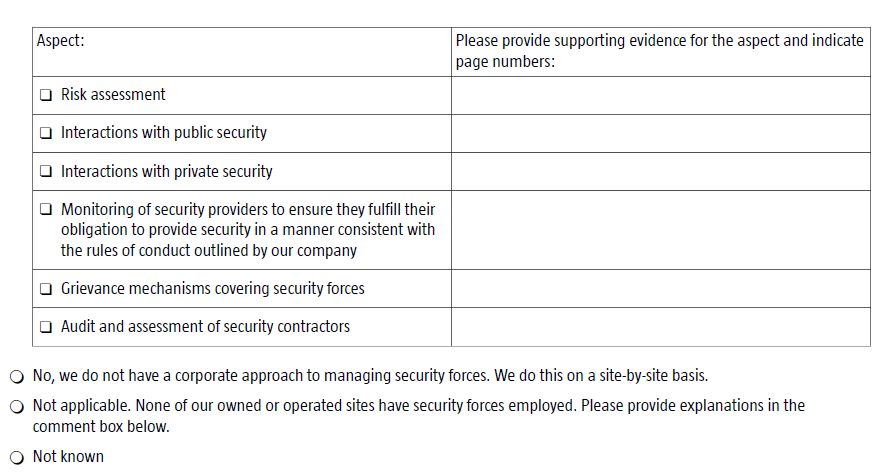

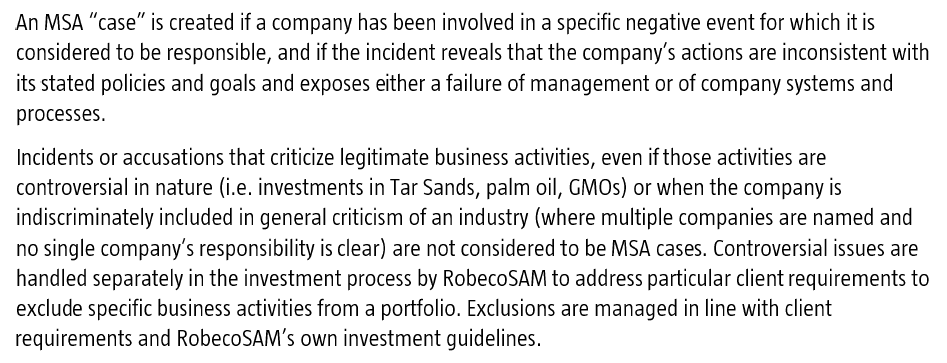

The DJSI’s questionnaire appears to be predominantly asking if companies such as Newmont have the necessary policy to address commonly known ESG concerns related to their industry. The implementation of the policies is then verified with the DJSI’s Media and Stakeholder Analysis (MSA). How reliable DJSI’s ratings are therefore depends greatly on this verification process. For reference, the below extracts show how DJSI defines a “MSA case” (negative ESG issue):

MSA case definition, from DJSI

Further, a company’s “responsibility” is defined as:

DJSI appears to be responsive to how well the companies actually implement internal ESG policies. In 2018, MSA score calculation was changed to essentially penalize companies more in their ESG performance score, if they had a known case of negative ESG issue (a “MSA case”). This change in methodology has significantly lowered many companies’ overall ratings, and has been applied in the 2018 assessment.

While the DJSI appears to provide good guidance for ESG-concerned investors, with clear methodology publicly available online for scrutiny, one limitation of the MSA methodology is if DJSI is aware of a “MSA case”. It appears that if a MSA case (a negative ESG issue) is not sufficiently elevated, it may not gain the attention and awareness of DJSI’s analyst, and may not factor into the consideration of the ESG rating.

Conclusion

Through this post I have taken a look at what ESG ratings means, using Newmont Mining’s DJSI’s ratings in 2018 as an example. While the DJSI employs a methodology which penalises company’s for negative ESG issues, the use of third party ESG rating agencies such as DJSI ultimately leads us to the next question of how investors using such ratings may encourage change in the companies they invest in. It seems possible that if investors become too reliant on ESG ratings from third-parties, they may in turn reduces the need for in-house industry experts who are better able to conduct corporate engagements with investee companies to encourage change.